/01/Trillion imagination

The term “synthetic biology” first appeared in the 1970s, until it was redefined by Stanford professor Eric Kool in 2000 by introducing engineering concepts based on genomics and systems biology, marking the emergence of this discipline.

Simply put, synthetic biology is the use of engineered organisms such as bacteria to produce various things we want, from fuels such as diesel, chemicals like plastics and nylon, to skincare ingredients like squalene, and flexible screen materials for mobile phones… Its mission is to solve various problems faced by humans, such as food scarcity, energy scarcity, environmental pollution, medical and health issues.

As a multidisciplinary interdisciplinary fusion of biology, bioinformatics, computer science, chemistry, materials science, and other fields, synthetic biology is more like an underlying platform, essentially upgrading the entire production and manufacturing industries such as consumer, medical, agricultural, and chemical industries.

The lofty ideal of synthesizing all things and reshaping the material world brings trillions of imaginative space to it. According to CB Insights analysis data, the global synthetic biology market reached $5.3 billion in 2019 and is expected to reach $18.9 billion by 2024. According to McKinsey’s estimates, the economic impact of synthetic biology is expected to reach $1.8 to $3.6 trillion annually from 2030 to 2040.

However, from the establishment of Chinese synthetic biology giant Kaisai Biotechnology in 2000, to the great success of Amyris’ artemisinin in 2006, and then to the emergence of gene editing technology CRISPR-Cas9 in 2013, until April 2021, when Zymergen, with more than ten research and development pipelines, went public in the long-awaited market; In September, Ginkgo Bioworks, a synthetic biology platform company, made its debut in the secondary market with the largest SPAC M&A transaction in history, with a market value of over $20 billion.

Exciting news came rapidly from the other side of the ocean, and after more than 20 years of ups and downs in development, synthetic organisms were finally pushed to an explosive point.

Just a year ago, synthetic biology was almost unknown in the investment community. However, by 2021, the situation had undergone a revolutionary change, with investment institutions from other fields such as biopharmaceuticals and mass consumption flocking in.

According to Synbiobeta data, the total global financing in the field of synthetic biology in 2021 was approximately $18 billion, equivalent to the total of the past 12 years.

/02/The logic of explosion

Why did it become popular at this time point?

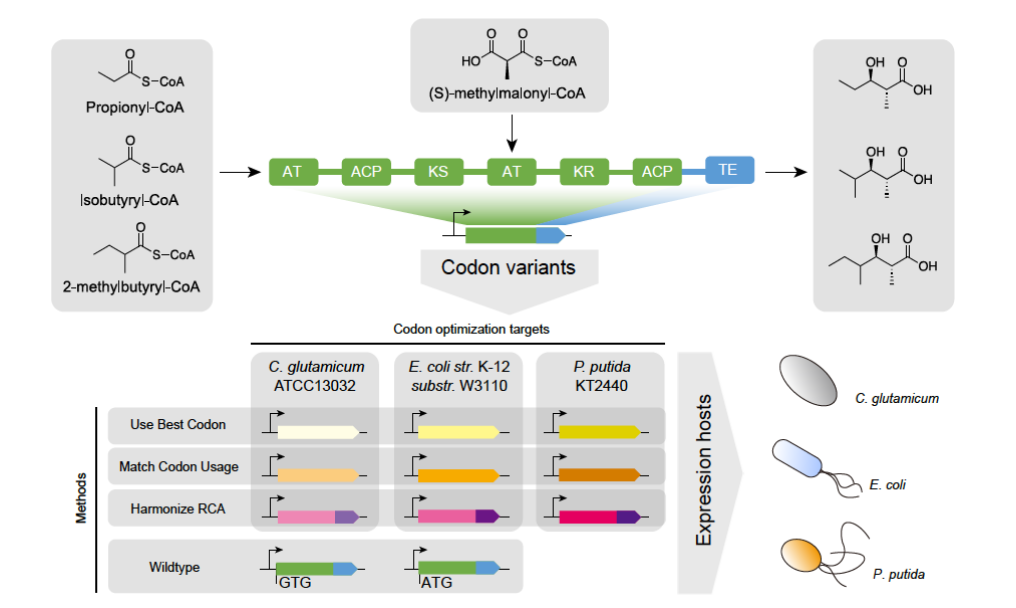

One of the most core reasons is that from 2015 to 2017, various new technologies and tools began to be popularized, such as DNA synthesis, sequencing, editing techniques, and the development of AI tools. These technologies accelerated the experience accumulation and iteration speed and flux of strain modification researchers.

It will take approximately 5 years until the results of these laboratories are preliminarily industrialized. In 2021, this process was identified and discovered by capital when it overlapped with the listing applications of several companies on the track.

Specifically, for over 20 years, the question that synthetic biology has been questioned is whether it can truly produce mass-produced, cost-effective products through biosynthesis. In the past few years, a batch of raw material products have truly achieved concept validation, including long-chain dicarboxylic acid, alanine, PHA, HMO (human milk oligosaccharides), collagen, and propylene glycol.

Taking long-chain dicarboxylic acids as an example, they have a wide range of uses. They can be used as monomers to synthesize high-performance polyamides, as well as important raw materials for musk flavorings, paints, coatings, lubricants, plasticizers, new pharmaceuticals, and pesticides. Its production methods mainly include chemical and biological methods. Compared with chemical methods, biological methods have the characteristics of low cost, high material conversion efficiency, less pollution emissions, and mild production conditions.

Kaisai Biotechnology is the world’s first and currently the only enterprise that can use biological methods to implement large-scale industrialization of long-chain dicarboxylic acid technology, breaking foreign technological monopolies. At present, its long-chain dicarboxylic acid products have a market share of 95% in China and a market share of nearly 80% in the international market.

At that time, the quotation for chemical method was $9 per kilogram, while Kaisai Biological’s quotation for biological method was $5 per kilogram. Due to its cost advantage and continuous increase in production capacity, Invidia closed its long-chain dicarboxylic acid production line in the United States in 2016, and Kasai Biotech finally achieved a complete replacement of chemical long-chain dicarboxylic acid.

In 2021, from the US stock market to the A-share market, Synthetic Biology experienced almost a whole year of frenzy.

The stock price of veteran synthetic biology company Amyris gradually rose at the end of 2020, and by March 2021, it had risen from $2 per share to $20, with a market value of over $7 billion.

On the domestic side, with the listing of Huaheng Biotechnology on the A-share market, two downstream application-oriented companies – Huaheng Biotechnology and the previously listed Kaisai Biotechnology – continued to soar until the end of 2021. This year, the stock price of Kaisai Biotechnology has doubled, and the stock price of Huaheng Biotechnology has more than tripled when it went public.

This has shown venture capital firms in the primary market the path of synthetic biology IPO exit and the hope of increasing valuation multiples.

The development of underlying technologies, some products that have truly achieved concept validation and implementation, coupled with the wealth creation effect of the secondary market and the concept of carbon neutrality, have jointly contributed to the explosion of synthetic biology in 2021.

/03/From laboratory to mass production

In just two years, the landscape of the synthetic biology track has changed greatly, with mountains and rain approaching.

Ginkgo’s market value has fallen from a high of $20 billion to $2.8 billion; As a former product oriented leading enterprise, Zymergen’s first commercial product failed and the company was ultimately acquired for only $300 million, with a cumulative financing amount of nearly $1 billion; Elder Amyris declared bankruptcy in August.

The occurrence of these changes seems to mark a turning point in the field of synthetic biology, as the decline and setbacks of leading companies have sounded an alarm for the entire industry.

The domestic heat is also beginning to fade, and the market is quickly re examining this track. From the second half of 2022 until now, the wind has shifted in another direction: startups that have not yet achieved revenue or do not have industrialization capabilities are rarely considered.

Because synthetic biology has sparked a revolution in the manufacturing industry, once it comes to manufacturing, as Musk said, laboratory production/prototype development is easy, while large-scale production is the tough nut to crack.

The founder of Blue Crystal Microorganisms, Zhang Haoqian, who has now reached the stage of industrialization, shared this experience in a public interview, The team was producing PHA (a biodegradable bio based material) at that time The strain used is halophilic microorganisms, which grow in high concentration saline water and can avoid contamination by miscellaneous bacteria. This idea works well in the laboratory, but it is not feasible in actual production because the wastewater it produces is high salt and organic matter wastewater, and its sewage treatment cost is two orders of magnitude higher than ordinary wastewater, which is simply not feasible in actual production

This reflects that there is a huge gap between the synthesis of a few grams of things in the laboratory and the large-scale production of kilograms and tons, and multiple links may deviate.

For example, the development of bioreactors. In the laboratory, the fermentation mass transfer rate and other conditions are controllable, but after the reactor is enlarged, the local microenvironment will change, which has a significant impact on the process and fermentation results;

For example, as cells continue to divide and the reactor amplifies, the number of amplifications increases, which may disrupt the genetic stability of the bacterial strain; Downstream separation and purification, each step also has multiple technical routes. If the process is outdated or the cost is high, it will also affect the overall competitiveness of the product.

In addition, the cost and stable supply of raw materials and culture media must also be considered in advance. Especially for bulk products, when the factory’s production capacity is planned to reach 10000 tons, fluctuations in upstream raw material prices, transportation costs, and even the consumption of water/electricity directly affect the cost of the product.

Of course, the logic driven by synthetic biological data is driving traditional fermentation from extensive curve changes to deeper metabolic flow analysis; From empirical intuition to data analysis combined with automation equipment.

Domestic and foreign enterprises that started synthetic biology early and have entered the mass production stage have established automated data collection systems. A typical example is Kaisai Biotechnology, which uses online sensor technology to collect multiple parameters in the biological metabolism process, conduct big data analysis, implement intelligent control processes, gradually amplify the fermentation reaction of long-chain dicarboxylic acids, and achieve stable product cost and quality.

Overall, from the laboratory to the factory, it is necessary to consider both technical costs and actual production issues comprehensively.

/04/ The logic of product selection

Looking back on the industry’s hot financing frenzy in 2021, and now that Amyris is bankrupt, one cannot help but marvel at the power of cycles: the period when the Federal Reserve tightens liquidity is the real test of the industry and companies.

Of course, compared to macroeconomic cycles, what is more important is the fundamental business logic: how businesses make money.

In fact, the lessons of Amyris and Zymergen each dedicating themselves to biofuels and optical thin films, but failing to do so, have led to a consensus in the domestic synthetic biosphere that they should not only focus on technology but also whether they can achieve it; We also need to consider whether it can be sold in the market.

That is to say, the selection logic is equally important.

Through synthetic biology technology, many products can indeed be produced, and everyone is laying out different product pipelines and application fields. The key is to make them fast or slow, cost high or low, and whether the market really needs them.

For startups, a more feasible approach may be to prioritize choosing high value-added fine chemicals.

If we start with bulk chemicals, mass production requires high cost control and industrialization capabilities. For example, DuPont’s production of 1,3-propanediol requires a huge amount of capital and takes a long time to achieve mass production, making it difficult for startups to afford such high costs and long-term investments.

The back-end fermentation production scale of bulk commodities needs to reach thousands or tens of thousands of tons in order to gain a certain market share and dilute production costs, such as bio based materials such as PHA and butanediol, sweeteners such as steviol glycosides, etc. The risk of scaling up mass production in this way needs to be carefully measured, and large-scale factory construction also relies on heavy asset investment, requiring enterprises to be able to continue financing in the capital market.

In contrast, some high value-added fine chemicals and highly active molecules, sold in kilograms or grams, have stronger progressiveness during the process amplification. Products of pilot scale in small-scale trials can already bring cash flow to enterprises.

Of course, the most ideal scenario would be to reduce the cost of converting fine chemicals into bulk chemicals, which would result in both profits and a market.

Choosing the right key categories not only determines the phased cash flow of synthetic biology enterprises, but also determines the overall direction of the enterprise.

Besides product orientation, platform orientation is also a business model.

The core barriers for such enterprises are their technological capabilities in modifying chassis cells and whether the genome database is strong. Represented by overseas Ginkgo Bioworks, we provide manufacturers with microbial strain based solutions through the highly automated work mode and code library (biological data assets) of “Life Foundry”. In 2022, Ginkgo’s total revenue reached $478 million, but its current market value has fallen below $3 billion, far below the previous $20 billion.

This may be because platform based enterprises have avoided the risk of product development failure, but have also abandoned the value chain of later brands and products. In the early stages of industry development, the value of pure “infrastructure” is still limited.

Of course, product or platform, which is better or worse? There is no consensus yet.

Pioneers have successfully crossed the “Death Valley” of synthetic biology from laboratory research and development to industrial mass production. In the future, more frequent explorations and attempts will be made to better reshape the material world.

Related recommendations

DNA Synthesis and Assembly

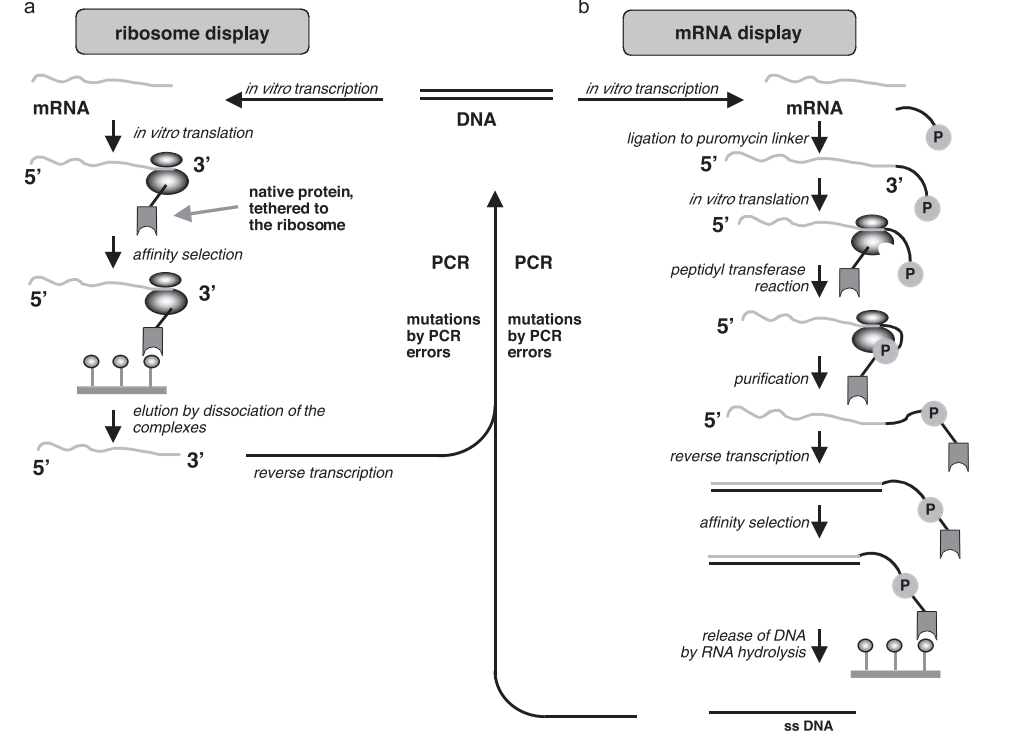

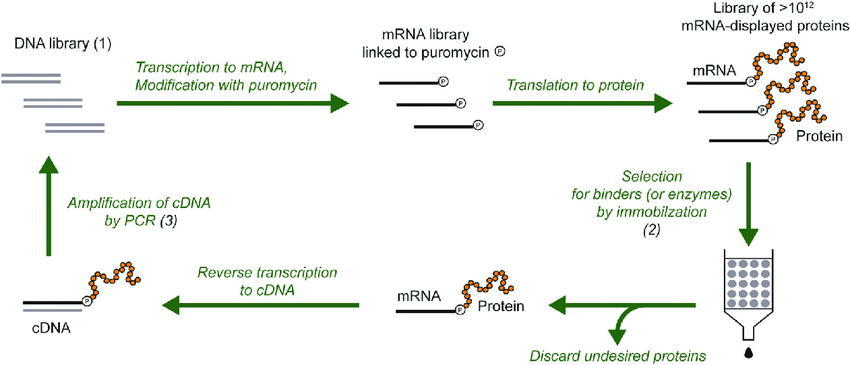

Genetic Engineering and Gene Editing

Protein Engineering and Optimization

Metabolic Engineering and Pathway Design

Strain Development Service